REGular Blog: NCUA Board Meeting Summary - Jan. 18, 2024

While our credit unions were making their way up and down the halls of the General Assembly Building in Richmond, the NCUA Board was holding its January Board meeting, marking the first with NCUA's newest Board member, Tanya Otsuka. Board member Otsuka was sworn in by Chairman Harper last week, and she replaces Board member Rodney Hood, whose term expired last year.

Board Briefing - NCUA's 2024-2026 DEIA Strategic Plan

At Thursday's meeting, the NCUA reviewed its DEIA Strategic Plan for 2024-2026. Staff from the agency presented information about their diversity, equity, inclusion, and accessibility goals and strategies.

Chairman Harper emphasized the commitment of credit unions to serving underserved and marginalized communities and spoke to the business case of DEIA programs. He detailed how credit unions can evaluate their own efforts with a self-assessment.

Vice Chairman Hauptman agreed that diverse workforces make us better and stronger while diving deeper into some actions that would not promote diversity, including the NCUA telling credit unions who should be on their boards, or small credit unions being forced to close or merge by regulatory burden. He emphasized that resources should not be made available or unavailable on the basis of race, gender, or similar factors.

Board Member Otsuka noted that it's critical that all employees feel welcome in the workplace and stressed the importance of reducing barriers to accessibility. She noted that diversity within credit unions is important because they need representation from the communities that credit unions seek to serve and that it is important to keep in mind the additional work needed, not just regarding race or gender, but on veteran status, level of ability, and other forms of representation.

NCUA Board members noted that outgoing Board member Hood was a key driver in the agency's establishment of an annual DEIA Summit.

NCUA's 2024 Annual Performance Plan

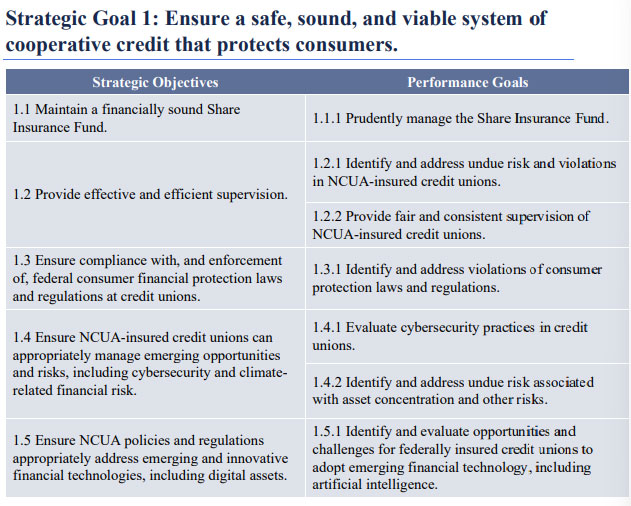

The Board unanimously approved the agency's 2024 Annual Performance Plan. The plan gives the agency direction on achieving its strategic goals. These goals are laid out in the NCUA's 2022-2026 Strategic Plan, which sets the following strategic goals:

- Ensure a safe, sound, and viable system of cooperative credit products that protect consumers;

- Improve the financial well-being of individuals and communities through affordable and equitable financial products and services; and

- Maximize organizational performance to enable mission success.

Every strategic goal is broken out further with strategic objectives and performance goals, as shown below for the first strategic goal.

The NCUA's Office of the CFO will measure and report the agency's progress toward achieving these goals.

Operating Fee

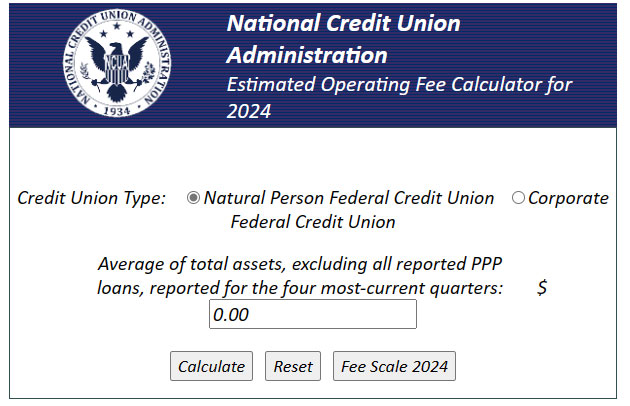

In non-Board-meeting-related NCUA news, the agency this morning published a Letter to Credit Unions on the 2024 Operating Fee. The letter includes the NCUA Operating Fee calculator, where a credit union can input their asset size to estimate their operating fee for 2024.

One benefit new this year for the smallest credit unions is that the threshold for a waiver of the operating fee has been raised from $1 million in assets to $2 million. The League supported this change with a comment letter submitted to the agency as they were considering the change.

NCUA Operating Fees are due April 18, 2024.

That's all for now - we'll be watching the agency's 2024 Supervisory Priorities List, which can shed some light on what areas will be a focus for the "new" NCUA Board.

- Share on Facebook: REGular Blog: NCUA Board Meeting Summary - Jan. 18, 2024

- Share on Twitter: REGular Blog: NCUA Board Meeting Summary - Jan. 18, 2024

- Share on LinkedIn: REGular Blog: NCUA Board Meeting Summary - Jan. 18, 2024

- Share on Pinterest: REGular Blog: NCUA Board Meeting Summary - Jan. 18, 2024

« Return to "REGular Blog" Go to main navigation