REGular Blog: Weekly Roundup: April 25th

Happy Thursday everyone! Here at the League we are gearing up for our IGNITE conference next week - I hope to see many of you there! In the past week we've gotten an ANPR from NCUA on records preservation, an analysis from FinCEN on elder financial exploitation SARs and CTRs, and some updated FAQs on Beneficial Ownership Information reporting. Let's dive in!

NCUA Issues ANPR on Record Retention

The NCUA Board has issued an Advance Notice of Proposed Rulemaking (ANPR) (link: https://ncua.gov/files/agenda-items/records-preservation-program-anpr-20240418.pdf) related to records preservation. The agency is using the ANPR to solicit comments and feedback on how it can improve and update its records preservation program regulations and guidelines in Part 749. In the ANPR, the NCUA notes that Part 749 has not been updates in 15 years and "may be outdated or at adds with current best practices."

During the April Board meeting, the NCUA cited a meeting with leaders from small credit unions that was a key driver in spurring this ANPR. Vice Chairman Hauptman noted that credit unions only get in trouble for not retaining documents long enough, but never get in trouble for keeping them too long. As a result, many credit unions retain numerous documents for much longer than the NCUA wants or needs them to.

During the meeting, he posted pictures of a storage unit full of banker’s boxes and stacks of paper that a credit union sent to him. Storage costs for these records run the credit union thousands of dollars a year. He also noted that you can't simply just scan these documents - many documents are old and frayed, on different types of paper, etc. that bring logistical challenges, in addition to the labor costs of scanning.

The ANPR asks a series of questions. Some are related to the language of the regulations themselves. Others seek information on credit union practices related to record retention. It is fairly open ended and will allow credit unions and trade groups to submit a wide range of feedback related to record retention for the NCUA to consider incorporating into changes to Part 749.

This is the first step to a multi-part process. The ANPR was published in the Federal Register on April 24th. The comment period will close on June 24th. After that, the NCUA will review comments and incorporate them into a proposed rule. This proposed rule will contain amendments to Part 749. There will be another comment period on the proposed rule. After that, the NCUA will consider feedback and issue a final rule. The whole process will take a number of months. However, NCUA is clearly approaching this with an eye reducing regulatory burden while still maintaining the records necessary for backups and other emergency situations.

The League will be submitting comments on the ANPR. If you have any feedback or practices you'd like to share, please email me at jblau@vacul.org.

FinCEN Releases Report on Elder Financial Abuse

This week FinCEN released a Financial Trend Analysis (link: FinCEN Financial Trend Analysis) providing threat pattern and trend information on Elder Financial Exploitation (EFE) incidents. The report used data from BSA reports filed between June 15, 2022 and June 15, 2023. The report notes that FinCEN received 155,415 EFE-related BSA reports during this time period, with more than $27 billion in reported suspicious activity.

The report's key findings include:

- FinCEN identified two predominant categories of victimization across EFE-related BSA filings: (1) elder scams, where the victim does not know the perpetrator; and (2) elder theft, where the victim knows the perpetrator.

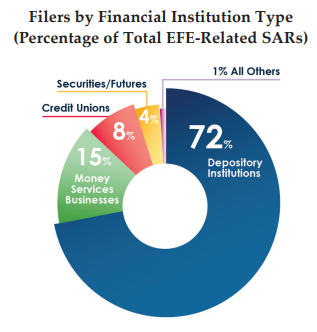

- Banks Filed 72 Percent of All EFE-Related BSA filings: Two banks reported 33 percent, or 50,670 BSA filings, of the filings in the dataset. These bank filings mostly reported their customers as victims or perpetrators, but also included reports where the filer acted as a correspondent bank.

- Financial Institutions Filed More Elder Scam-Related BSA Filings than Elder Theft-Related BSA Filings: BSA filings relating to elder scams accounted for approximately 80 percent of reported EFE-related activity. This does not necessarily indicate that scams occur more often than theft, but filers are reporting on it more frequently.

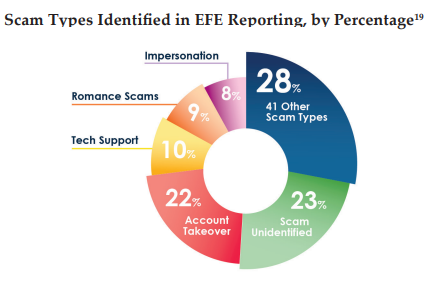

- Account Takeover is the Most Frequently Cited EFE Typology: The majority of elder scam-related filings also referenced account takeover activity.

- Adult Children are the Most Frequent Elder Theft-Related Perpetrators: BSA filers reported adult children as the perpetrators of elder theft in nearly 40 percent of cases, based on a manual review of EFE-related filings.

- Reliance on Unsophisticated Methodologies and Avoiding Human Contact: Perpetrators mostly rely on unsophisticated means to steal funds that minimize direct contact with financial institution employees. These include using previously compromised identifying information and/or passwords, guessing passwords, or mass spam emails that elicit replies containing sensitive information.

The report noted that credit unions filed 8% of the total EFE-related SARs during the review period:

The report also noted w broad mix of the types of scams identified in EFE-related reports, including romance scams, account takeovers, impersonations, and tech support scams, among others:

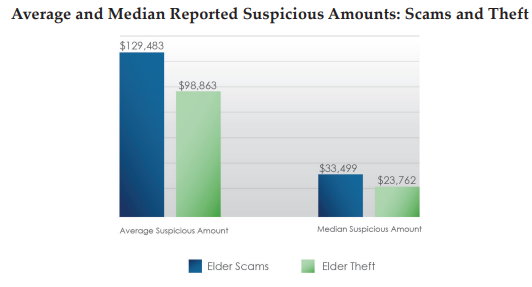

Dollar amounts involved in these scams are high, especially for scams. The average reported suspicious amounts for elder scams during the review period was $129,483. The average elder theft amount was $98,863. The median figures were high as well:

Credit unions and banks have been pushing FinCEN for years for more data and feedback on how SARs and CTRs are being reviewed and used, so it's great to see data like this released. Elder financial exploitation continues to be an issue credit unions are working to protect their members against.

FinCEN Updates FAQ on CTA, FIs May Access Beneficial Ownership Database Next Year

Last week FinCEN released new FAQs related to the Beneficial Ownership Information (BOI) Reporting Rule and the BOI Access and Safeguards Rule. In FAQ O.1. FinCEN provides details on their planned phased approach to accessing the BOI database:

O. 1. When will authorized recipients have access to beneficial ownership information?

FinCEN will take a phased approach to providing access to beneficial ownership information.

- The first phase, expected to begin in the spring of 2024, will be a pilot program for a handful of Federal agency users.

- The second phase, expected in the summer of 2024, will extend access to Treasury offices and other Federal agencies engaged in law enforcement and national security activities that already have memoranda of understanding for access to Bank Secrecy Act information.

- The third phase, expected in the fall of 2024, will extend access to additional Federal agencies engaged in law enforcement, national security, and intelligence activities, as well as to State, local, and Tribal law enforcement partners.

- The fourth phase, expected in the winter of 2024, will extend access to intermediary Federal agencies in connection with foreign government requests.

- The fifth phase, expected in the spring of 2025, will extend access to financial institutions subject to customer due diligence requirements under applicable law and their supervisors.

FinCEN is not currently accepting requests for access to beneficial ownership information. FinCEN will provide further guidance on how to request access in the future.

As we can see, FinCEN anticipates banks and credit unions to be able to access the BOI database in the Spring of 2025. Of course, like so many new regulatory updates these days, FinCEN is planning for this rollout while at the same time facing defending the constitutionality of the legislation in Court. A case challenging the constitutionality of the Corporate Transparency Act (CTA) has been filed in the 11th Circuit, and this week the Court granted the parties' request for expedited briefing. Briefs must be submitted by June 3rd, with oral arguments to follow on the first available date. The Court appears to be moving quickly given the January 1, 2025 deadline for businesses formed before 2024 to file their beneficial ownership information with FinCEN. You can read more about recent developments in the court case here.

That's all for now - we won't have a weekly roundup next week due to the IGNITE conference, but we'll be back again the week after with the latest happenings in credit union regulatory compliance.

« Return to "News" Go to main navigation