REGular Blog: Swipe Fee Settlement Reached Between Visa, Mastercard, and Merchants

On Tuesday morning, news broke that a landmark antitrust class action settlement had been reached between U.S. merchants, Visa, and Mastercard related to swipe fees.

A press release by Grant & Eisenhofer, one of the law firms involved in the case on the merchants’ side, describes the key elements of the settlement:

1) Applying three separate brakes to swipe fees, delivering merchants at least $29.79 billion in savings over the next five years.

- Brake 1: Visa and Mastercard will roll back the posted swipe fee of every merchant by at least four basis points for at least three years.

- Brake 2: For a period of five years, Visa and Mastercard will not raise the swipe fees of any merchant above the posted rates that existed as of December 31, 2023.

- Brake 3: For a period of five years, the average effective systemwide swipe fee for Visa and Mastercard must be at least seven basis points below the current average rate. An independent auditor will verify the calculations.

2) Removing anti-steering restrictions and enabling competitive pricing.

- Merchants can charge for using a Visa or Mastercard credit card, regardless of whether they can charge for using American Express, whose rules for merchants were upheld by the Supreme Court in 2018.

- Merchants can discount at the issuer level thereby steering consumers to more preferred cards and promoting increased competition among the networks and the numerous credit card issuers.

- Merchants will be able to adjust prices based on the costs associated with accepting different credit cards, promoting efficient price signaling and enhancing transparency for consumers.

- Merchants will be permitted to provide customers truthful information as to why they are applying a charge for credit card use.

3) Increasing small merchants' ability to negotiate lower swipe fees from Visa and Mastercard.

- Visa and Mastercard must negotiate swipe fees in good faith with merchant buying groups, and the agreement provides a streamlined process for resolving disputes.

4) Allocating $15 million for a merchant education program to advise and inform merchants on the settlement and effectively utilizing the rule changes.

- This will be the first independent merchant education program, available free of charge to all merchants of every size and category.

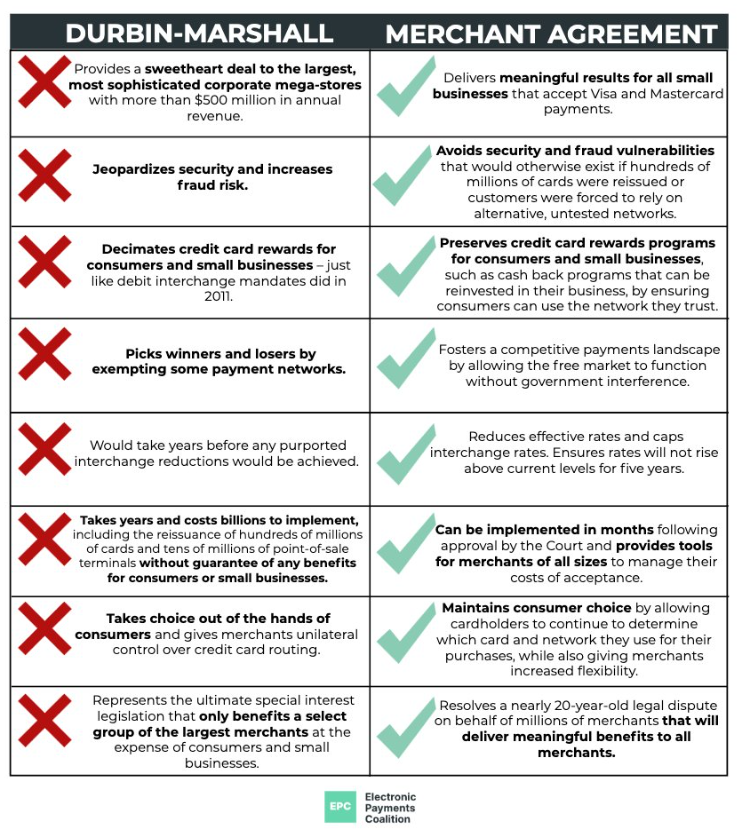

The settlement agreement, if approved by the courts, would accomplish many of the goals of the Credit Card Competition Act, which has been vigorously opposed by credit unions, banks, payment processors, and many others since its introduction in the summer of 2022. As such, the argument will be made that with this settlement the CCCA is no longer necessary, and efforts to pass it should be rolled back. The Electronic Payments Coalition put out the graphic below this morning, highlighting how the settlement is a better solution for the industry than the proposed legislation.

Both Visa and Mastercard denied wrongdoing in agreeing to settle. As for whether proponents of the CCCA will see the settlement as accomplishing the goals of the legislation, time will tell. The next major event in this battle was set to be a hearing in early April in the Senate Judiciary Committee. Senator Durbin, the primary proponent of the CCCA invited the CEOs of Visa, Mastercard, United Airlines, and American Airlines to testify. However, the day after the settlement was announced, it was reported that this hearing has been postponed, with no new date set as of yet. If the hearing does eventually happen, this settlement and its effects will certainly be a major topic of discussion.

We'll be monitoring this settlement's approval and its possible impact on both the CCCA as well as potential downstream effects on credit unions and other card issuers.

- Share on Facebook: REGular Blog: Swipe Fee Settlement Reached Between Visa, Mastercard, and Merchants

- Share on Twitter: REGular Blog: Swipe Fee Settlement Reached Between Visa, Mastercard, and Merchants

- Share on LinkedIn: REGular Blog: Swipe Fee Settlement Reached Between Visa, Mastercard, and Merchants

- Share on Pinterest: REGular Blog: Swipe Fee Settlement Reached Between Visa, Mastercard, and Merchants

« Return to "REGular Blog" Go to main navigation