REGular Blog: Bank Customers Are Having Accounts Closed ... Is BSA to Blame?

On Sunday, the New York Times posted an article titled "Why Banks Are Suddenly Closing Down Customer Accounts?"

The article details the practice of "exiting" or "de-risking," where "bank customers get a letter in the mail saying their institution is closing all of their checking and savings accounts." The author writes that banks are evicting what appears to be an increasing number of individuals, families and small business owners, many of whom "don't have the faintest idea why their banks turned against them."

The article points to the Bank Secrecy Act as being the reason behind many of these closings. Bank customers will do something to trigger a red flag on the customer, or perhaps multiple SARs have been filed. The bank will close the account, or notify the customer they have a certain number of days to make other banking arrangements. According to Thomson Reuters, the total number of SARs filed in 2022 exceeded 3.6 million, which is an increase of 57% from pre-pandemic levels.

The article goes on to detail the stories of several bank customers who had their accounts closed, and why they suspect they were closed. They include:

- A bar owner who made cash deposits from the bar's business, often in round number amounts and below $10,000. The account was closed due to suspected structuring.

- A woman whose bank asked for her tax returns and then closed her account - she suspects the fact that her husband's income comes from a cannabis company could be the reason.

- A man from Nigeria whose parents wired him money from Nigeria to help make rent.

- A man who took out cash to pay a contractor working on his house.

- A man with a criminal record who has had his accounts closed by three different banks. At his last bank, when he asked his banker why the account was being closed, his banker said "I'm not supposed to tell you this," then showed the man his mugshot on the computer monitor.

- A woman who started a susu - a community savings and loan pool.

It's a very interesting read, especially for anyone who has worked in BSA in the past. As I was reading, I thought back to my time as a BSA Officer. Our compliance team would meet twice a week and review accounts like several of these situations. We would decide whether to file or re-file SARs, or if we needed to contact the member to get more information. But what about terminating a customer relationship altogether? Is that something the BSA requires?

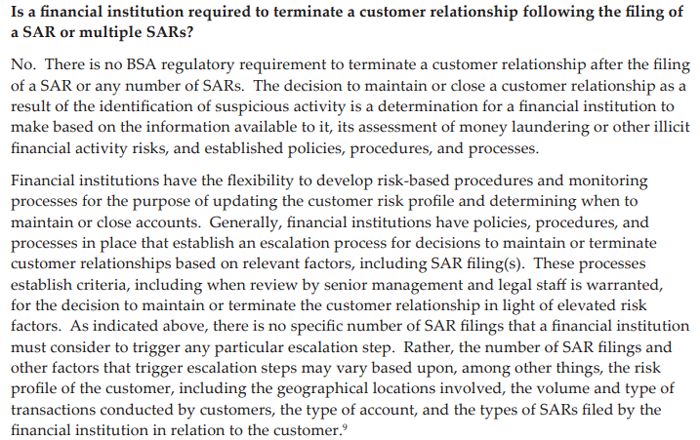

Straight from FinCEN, the answer is no!

Financial institutions must have a BSA program in place, file SARs and CTRs when required, and risk rate accounts, but the decision to close an account is solely in the hands of the financial institution and their risk-based policies, procedures and practices. No number of SARs will trigger this requirement.

One last note on the article: while diving into the comments section is always a risky proposition, I was curious. I opened the comments, clicked ctrl-f, and searched for "credit union." Here are some of the results:

- "Banks don't treat people like human beings. Use a credit union."

- "Get an account at a local credit union. I’ve had very good luck with them."

- "I’ve been with my local credit union for over 25 years and I’m very happy. I also have accounts with major banks but I don’t trust those for the important matters and transactions."

- "Use a credit union! Better customer service, Better security, Better rates."

- "I only bank with credit unions."

- "I’m so glad I moved to a credit union 20 years ago."

- "Maybe small businesses and ordinary consumers should take their money to local banks and credit unions who actually know their customers and their communities."

- "I don’t understand why anyone would use banks for personal banking. Credit unions seem far superior. They actually care about your interests. I’ve always been pleased with the products and care I have received at my credit union."

- "One of the reasons I left standard banking institutions years ago and only deal with credit unions."

- "Four words: Use a credit union."

- "I've been happy since I changed my banking to a local credit union and I often wonder why more folks don't switch as I have done."

You get the idea.

We can't lose sight of this. We talk to policymakers all the time about "the credit union difference." This is a prime example. Credit unions take pride in knowing their members and building member relationships. Transaction monitoring software is helpful and often essential, but often it doesn't tell the whole story. I can't tell you how many times an account or transaction was flagged as possibly suspicious but made sense when we talked to the member or knew about their situation.

Last September, we met with CFPB Director Rohit Chopra. During the meeting, he explained his view of two tiers of banking: relationship banking, and non-relationship banking. He called on those of us in the room to help him define what that distinction would look like. To borrow a line from Jeff Foxworthy: if an account gets flagged as suspicious, and your course of action is to mail a letter that you're terminating the banking relationship, you might not be in relationship banking.

Less "exiting" ... More relationship building.

- Share on Facebook: REGular Blog: Bank Customers Are Having Accounts Closed ... Is BSA to Blame?

- Share on Twitter: REGular Blog: Bank Customers Are Having Accounts Closed ... Is BSA to Blame?

- Share on LinkedIn: REGular Blog: Bank Customers Are Having Accounts Closed ... Is BSA to Blame?

- Share on Pinterest: REGular Blog: Bank Customers Are Having Accounts Closed ... Is BSA to Blame?

« Return to "REGular Blog" Go to main navigation