REGular Blog: An Update on NCUA Requiring Large Credit Unions to Report Overdraft and NSF Fee Income

A couple of weeks ago we wrote about NCUA Chairman Todd Harper's speech and discussion at the Brookings Institution, during which he discussed how NCUA would be amending the Call Report to require large credit unions (in this case meaning more than $1 billion in total assets) to report income from overdraft fees and NSF fees. He stated the agency was working on the change through the Paperwork Reduction Act. Today we are looking at what exactly are the changes that are being proposed as well as what is still unclear about the proposed change.

What will need to be reported?

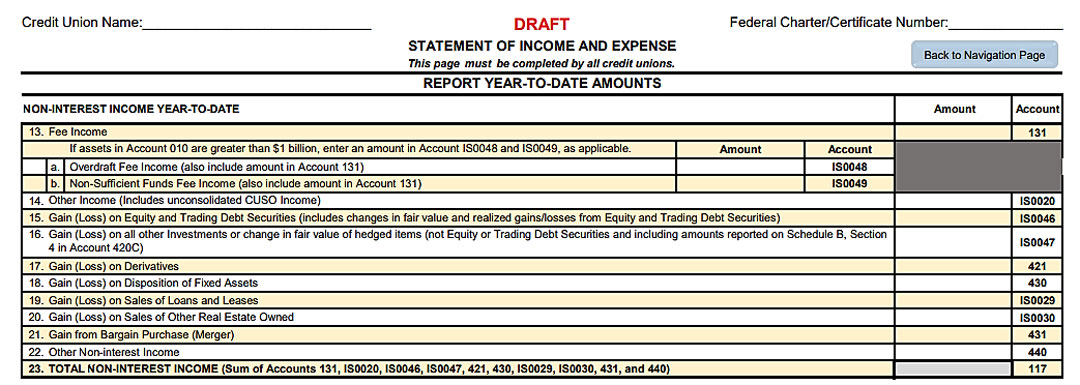

As proposed on Regulations.gov, the new Call Report will add fields to the Non-Interest Income portion of the call report. These two fields must only be filled out if the credit union is more than $1 billion in total assets. Here's how the proposed changes will look, in item 13:

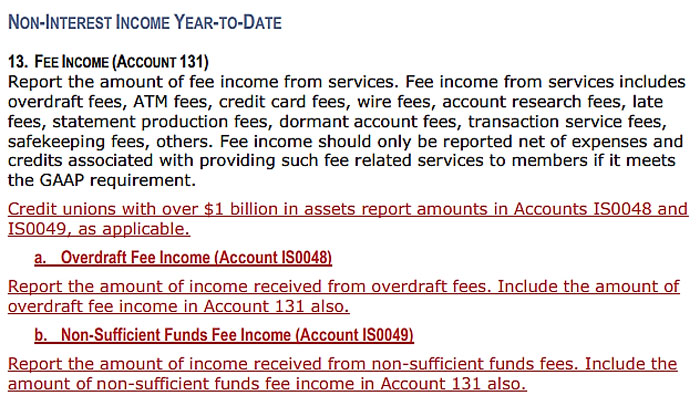

NCUA has also released its proposed changes to the Call Report Instructions regarding these items.

What Counts as an NSF Fee?

What is nowhere to be found in the proposed instructions is guidance on or a definition of what constitutes a non-sufficient funds fee. In the CFPB's recently proposed rule, which would ban NSF fees charged when a transaction is declined instantaneously at the point of sale, the CFPB defines what constitutes an NSF fee for purposes of the rule. As proposed, NCUA's new call report instructions do not contain such a description.

The challenge this poses is the potential for inconsistency across credit union reporting. Say Credit Union A and Credit Union B both charge a fee if they have to return an ACH transaction for insufficient funds. Credit Union A calls it a non-sufficient funds fee, but Credit Union B calls it a Returned Items fee. Both names accurately describe a fee that is charged for returning an item because of non-sufficient funds to pay it.

However, if the Call Report Instructions simply state to report NSF fee income, it could lead to Credit Union A reporting fee income that Credit Union B is not. This inconsistency would be problematic for the industry, would be counterproductive to NCUA's intent in requiring this information, and could lead to false or misleading reporting since NCUA call report data is public information.

If the NCUA does look to the CFPB for an NSF fee definition, here is how the CFPB defines it in their proposed rule banning NSF fees for instantaneously denied transactions:

|

2(e) Nonsufficient funds fee or NSF fee Proposed § 1042.2(e) provides that “nonsufficient funds fee or NSF fee” means a charge that is assessed by a covered financial institution for declining an attempt by a consumer to withdraw, debit, pay, or transfer funds from their account due to insufficient funds. This proposed definition also would clarify that the name used by the financial institution for a fee is not determinative of whether it is considered a “nonsufficient funds fee.” Unlike overdraft fees, which can also be charged in the event of insufficient funds, NSF fees as defined herein are only charged after a declined transaction. As a result, such fees may sometimes be referred to as “declination” fees or “bounced check” fees. The CFPB has also observed such fees labeled as, for example, “returned item fees,” “returned payment fees,” “uncollected funds fees,” “overdraft—unpaid fees,” and “shortage of funds fees.” This proposed definition broadly includes the types of fees that, if charged, would in substance constitute an abusive practice, regardless of how the fees are labeled. The CFPB seeks comment on its proposed approach to this definition. The CFPB also solicits comments on its examples of fee labels. (emphasis added). |

The FDIC also has language detailing NSF Fees in their call report documents:

Transaction or per item charges levied against deposit accounts for the processing of checks drawn against insufficient funds that the bank assesses regardless of whether it decides to pay, return, or hold the check, so-called "NSF check charges" (report as "Service charges on deposit accounts (in domestic offices)," in Schedule RI, item 5.b, or, if levied against deposit accounts in foreign offices, as “Other noninterest income” in Schedule RI, item 5.l).

Consumer overdraft-related service charges levied on those transaction account and nontransaction savings account deposit products intended primarily for individuals for personal, household, or family use. For deposit account products intended, marketed, or presented to the public primarily for individuals for personal, household, or family use, report the amount of service charges and fees related to the processing of payments and debits against insufficient funds, including “nonsufficient funds (NSF) check charges,” that the reporting institution assesses with respect to items that it either pays or returns unpaid, and all subsequent charges levied against overdrawn accounts, but excluding those fees equivalent to interest and reported in Schedule RI, item 1, “Interest and fee income on loans.”

(emphasis added).

We will see if NCUA puts out any further guidance on what they want credit unions to report on. Also uncertain at this time is whether these changes will become effective for the March 31, 2024 Call Report or will be delayed to a future time.

You can read more about these proposed changes to the Call Report on the America's Credit Unions Compliance Blog here.

- Share on Facebook: REGular Blog: An Update on NCUA Requiring Large Credit Unions to Report Overdraft and NSF Fee Income

- Share on Twitter: REGular Blog: An Update on NCUA Requiring Large Credit Unions to Report Overdraft and NSF Fee Income

- Share on LinkedIn: REGular Blog: An Update on NCUA Requiring Large Credit Unions to Report Overdraft and NSF Fee Income

- Share on Pinterest: REGular Blog: An Update on NCUA Requiring Large Credit Unions to Report Overdraft and NSF Fee Income

« Return to "REGular Blog" Go to main navigation