Friday Five: Five Key Points from the NCUA Quarterly NCUSIF Briefing

Happy Friday! Without fail, September in Virginia brings us rainy weather, as storms move in from the Atlantic and up the east coast. It looks like many of us are in for a wet weekend as Ophelia heads our way.

However, September also brings us the return of the NCUA Board meetings! After not having a meeting in August, as is the custom, the NCUA Board met Thursday to receive a quarterly briefing on the Share Insurance Fund as well as approve a Final Rule on Financial Innovation. We'll be covering the Final Rule in greater detail in the REGular blog next week. Today we're looking at the Share Insurance Fund briefing and five key data points. Let's dive in!

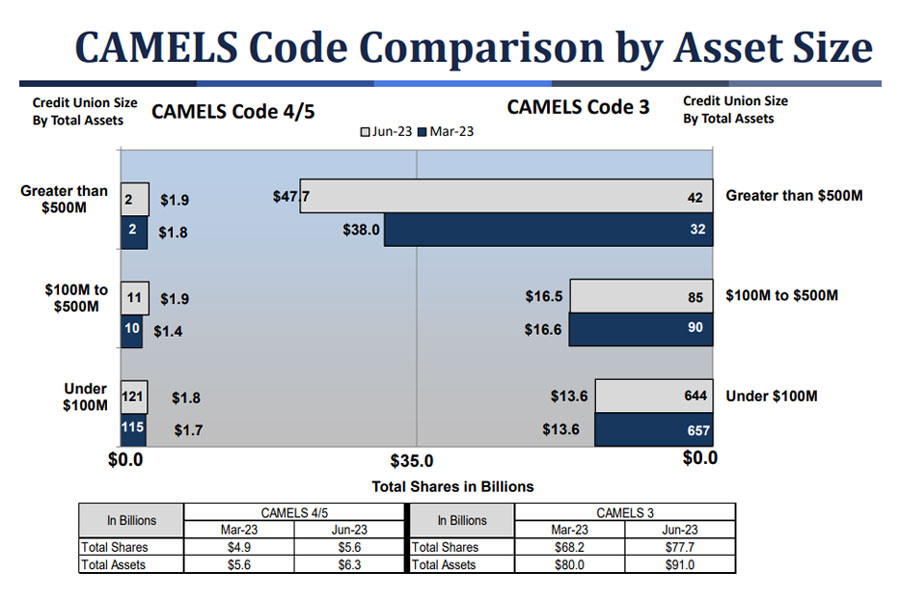

#1: CAMELS 3 Credit Unions above $500 million are on the rise

At the end of Q1 of 2023, there were 32 $500M+ credit unions with a CAMELS Code 3. The combined total assets of those credit unions was $38 billion. 3 months later, at the end of Q2, those numbers had increased to 42 credit unions with combined total assets of $47.7 billion.

This increase jumped off the page because of the visual contrast in the size of the bars in the bar graph. Chairman Harper asked NCUA about this trend during the meeting and if they expect it to continue. NCUA said that this trend goes back to December 2021 and they don't expect it to reverse any time soon. Household budgets face continued pressures with inflation, interest rate environment, credit card debt, resumed student loan payments, and more.

Board Member Hood also asked about this chart, specifically about what is driving the increase in CAMELS 3 credit unions of this asset size. NCUA cited liquidity risk, overall risk management, and credit risk as some of the common factors in these credit union examinations.

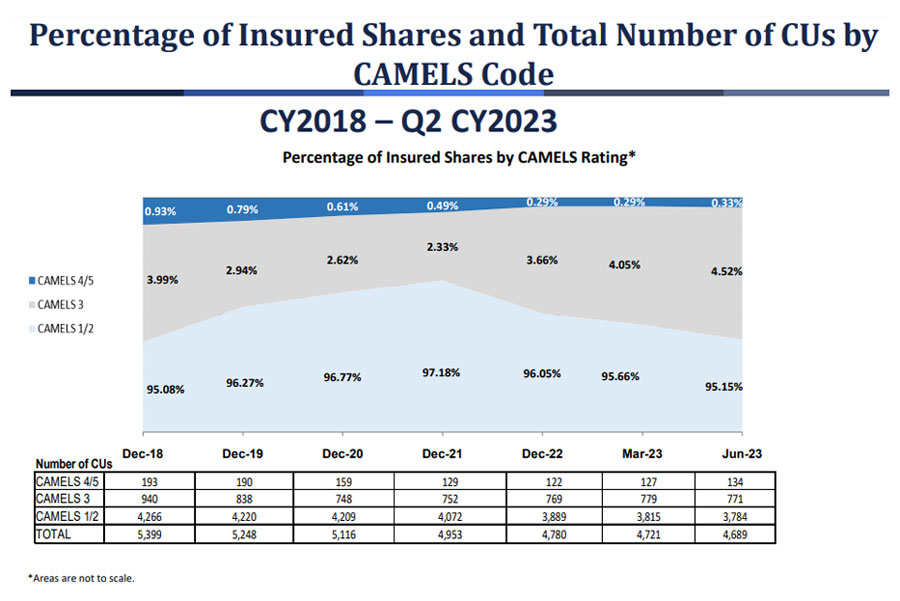

The chart below - while not to scale - shows the trend NCUA mentioned of rising shares in CAMELS 3 credit unions since 2021.

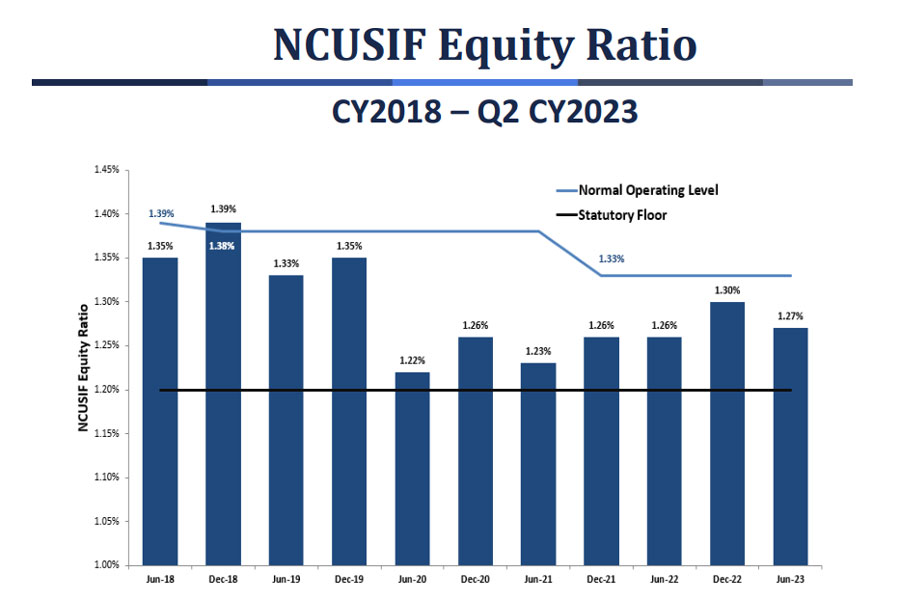

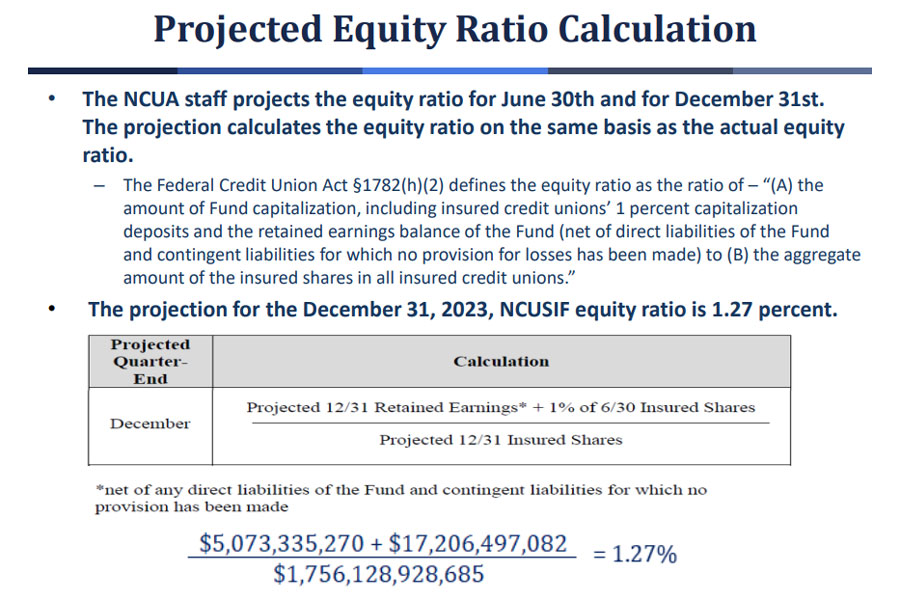

#2: The NCUSIF Equity Ratio is at 1.27%, and is projected to remain there

The Equity Ratio of the NCUSIF came in at 1.27% at the end of June. This is up slightly from projections made at the beginning of the year, which projected 1.25%. Chairman Harper noted that the 1.27% figure is almost exactly in the middle between the statutory floor of 1.20% and the Normal Operating Level of 1.33%.

NCUA noted the cyclical nature of the equity ratio, which is typically slightly higher in December and slightly lower in June. However, their current estimates project the equity ratio to hold at 1.27% during the December reading. If the equity ratio does hold at 1.27%, it will be interesting to see the discussion around the Normal Operating Level and if any adjustments should be made to that metric.

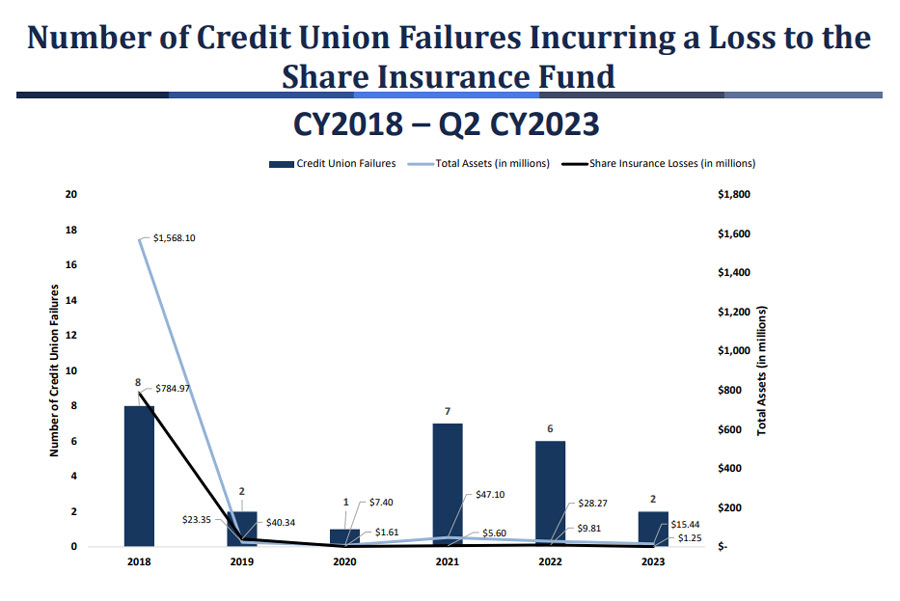

#3: There have only been 2 credit union failures causing losses to the NCUSIF this year

In the first half of the year, there were only two credit union failures that resulted in a loss to the NCUSIF. These losses totaled $1.25 million in incurred losses. Annualized, both these numbers are a downward trend, as can be seen in the chart below. 2021 saw 7 failures and $5.6 million in losses, while 2022 saw 6 failures with $9.81 million in losses.

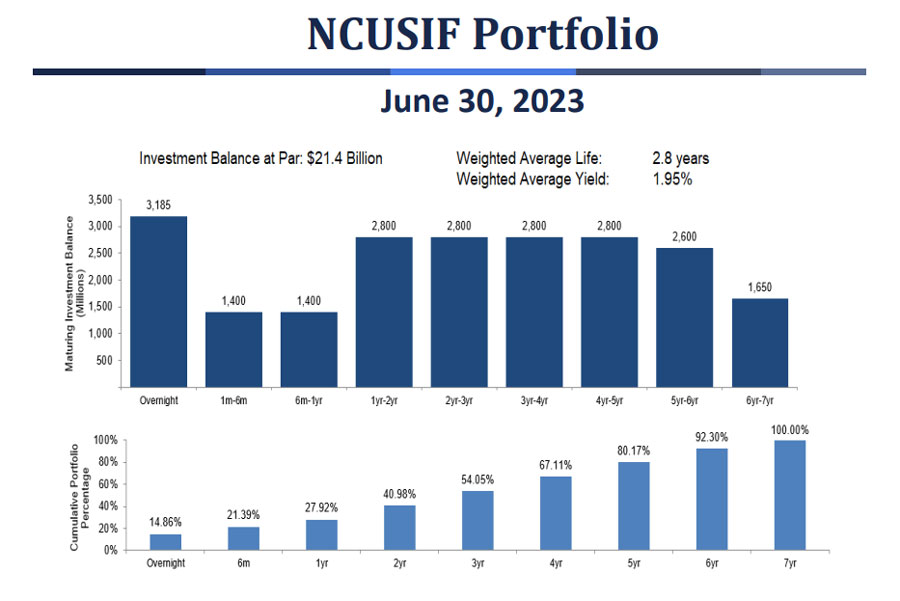

#4: NCUA continues to move investments to overnight accounts, maximizing yield and liquidity

The NCUA presented data on the maturity schedule of their investment portfolio. The NCUA's investment committee has set a target of $4 billion in overnight investments, which the portfolio is approaching, but not there yet. This means that as investments mature, they are being invested in overnight accounts rather than renewed as longer-term vehicles.

The investment portfolio's weighted average yield is 1.95%, with a weighted average life of 2.8 years.

NCUA has a number of investments which have an unrealized loss due to the rising rate environment. However, they intend to hold those investments to maturity. Vice Chairman Hauptman asked about the possible strategy of moving more funds into the overnight account to take advantage of the high yield. NCUA replied that to do that, they would have to sell underwater investments, which would turn their unrealized losses into realized losses. Instead, they will hold investments until they mature to avoid any realized losses. Board Member Hood asked about what the strategy will be once the $4 million overnight target is hit. NCUA replied that their investment committee, which meets quarterly, will consider a number of factors in setting the course once that bridge is crossed.

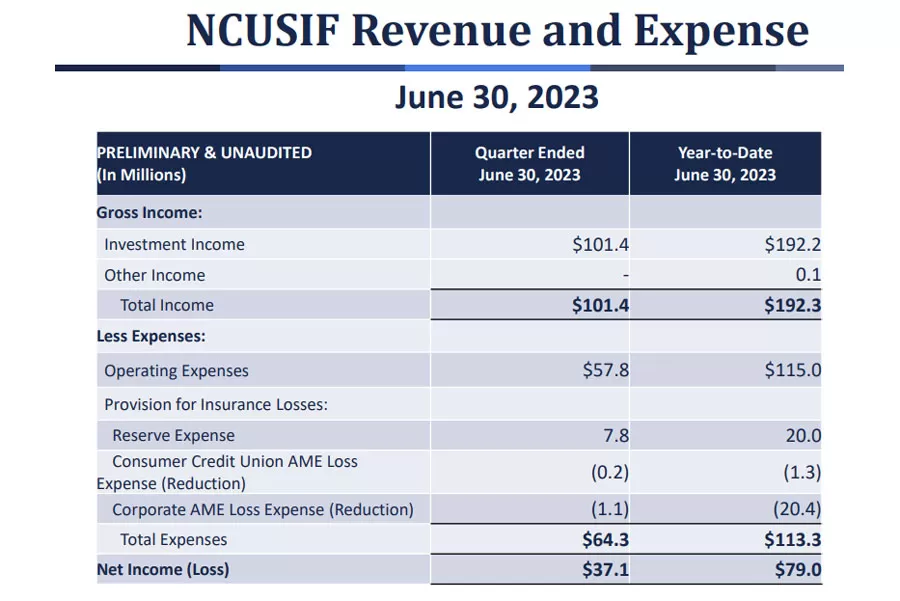

#5: NCUSIF income is up, but total assets are down

The NCUSIF posted quarterly net income of $37.1 million in Q2, bringing YTD net income to $79 million. This was due in large part to increased yields in the investment portfolio.

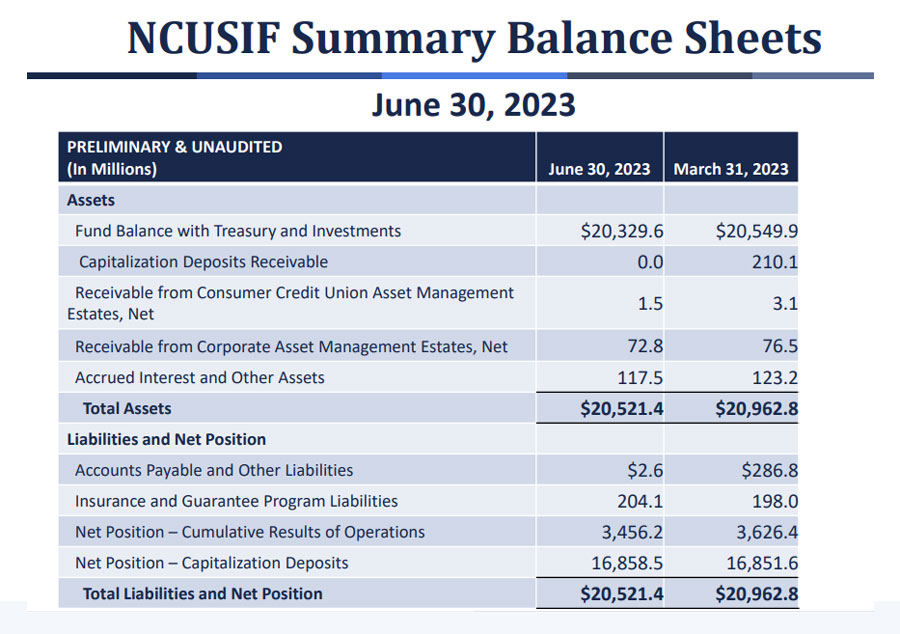

Total assets of the NCUSIF declined slightly in Q2, dropping from $20.9 billion on 3/31/2023 to $20.5 billion on 6/30/2023. In the meeting, NCUA cited a refund to credit unions that had lower insured shares as a reason for the decrease in assets in Q2.

The Quarterly NCUSIF Update gives some valuable barometers on the overall health of the credit union industry.

That's all for today - I hope everyone has a great weekend. Stay dry, and we'll be back next week with a breakdown of the NCUA's other agenda item from the Board meeting - the Financial Innovation Final Rule.

- Share on Facebook: Friday Five: Five Key Points from the NCUA Quarterly NCUSIF Briefing

- Share on Twitter: Friday Five: Five Key Points from the NCUA Quarterly NCUSIF Briefing

- Share on LinkedIn: Friday Five: Five Key Points from the NCUA Quarterly NCUSIF Briefing

- Share on Pinterest: Friday Five: Five Key Points from the NCUA Quarterly NCUSIF Briefing

« Return to "REGular Blog" Go to main navigation