FinCEN Releases Beneficial Ownership Small Entity Compliance Guide

Hello everyone! As summer comes to a close tomorrow, it’s a stark reminder how close to the end of the year we suddenly are. When the ball drops and rings in 2024, it will bring with it FinCEN's new beneficial ownership information (BOI) reporting rule!

Yesterday, FinCEN released a Small Entity Compliance Guide for its BOI reporting rule. The rule - part of the Corporate Transparency Act (CTA) of 2021, the Anti-Money Laundering Act of 2020, and the 2021 NDAA - will require many businesses to report information about their beneficial owners directly to FinCEN starting on January 1, 2024.

In March of this year, FinCEN published some initial guidance on the BOI reporting requirements and an FAQ page. In that publication, they indicated that additional guidance would be published in the coming months, including a Small Entity Compliance Guide.

Today's release of the Small Entity Compliance Guide is the next step in the agency's guidance as we approach 100 days until January 1, 2024. The Guide's goal is to help businesses determine if they are required to report beneficial ownership information to FinCEN.

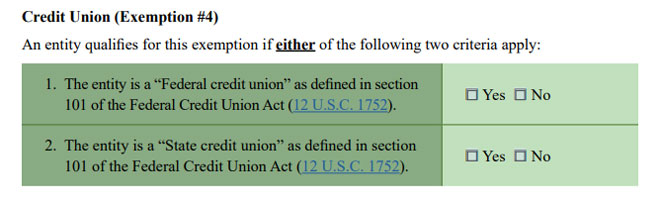

As for credit union impact - credit unions themselves are exempt from being required to report. In the Small Entity Guide, we can see this in Exemption #4 on Page 5:

However, credit unions will still be impacted by this rule. Credit unions that offer commercial accounts have been obtaining beneficial ownership information during account opening since May 2018, when the customer due diligence (CDD) rule became effective. Now, with this new rule, businesses will be reporting beneficial ownership information directly to FinCEN as well.

Many credit unions and other financial institutions initially hoped that if FinCEN was collecting this data themselves, that might relieve them of their obligation to collect this same data directly from members. That relief has yet to come to light. In fact, the rule may increase the compliance burden if credit unions are still required to obtain beneficial ownership information from their members while also pulling it from FinCEN's database. The CTA authorizes FinCEN to disclose BOI to a financial institution, but only to "facilitate the financial institution's compliance with CDD requirements under applicable law, and only if the reporting company first consent."

It remains unclear exactly what expectations the NCUA and other banking regulators will have for financial institutions when this new system goes live. Will credit unions be required to obtain BOI from members, then obtain their permission to check the registry, search the registry, compare registry results against those the credit union obtained, resolve any discrepancies, then store evidence of the pull, permission, and reconciliation? Will that process be required for all business accounts, or will it be risk-based? What does a credit union do if there is a discrepancy between what they collect and the registry? Will we ever get to the point where a credit union can simply rely on the registry and not gather BOI on their own? Speaking of the registry - how does a business report? What will the form look like?

Clearly there are still many questions on this issue. Some in the industry have called for an extension on this effective date, but there’s no sign that a reprieve may be coming. One important note is that when the calendar rolls over to 2024, existing businesses will have a full year grace period to report their BOI. Newly formed businesses after January 1, 2024 will have 30 days to report their BOI to FinCEN.

We'll report more as additional guidance is released.

Additionally, please add at the bottom. You can find additional information on the small entity compliance guide on CUNA’s Compliance Blog

- Share on Facebook: FinCEN Releases Beneficial Ownership Small Entity Compliance Guide

- Share on Twitter: FinCEN Releases Beneficial Ownership Small Entity Compliance Guide

- Share on LinkedIn: FinCEN Releases Beneficial Ownership Small Entity Compliance Guide

- Share on Pinterest: FinCEN Releases Beneficial Ownership Small Entity Compliance Guide

« Return to "REGular Blog" Go to main navigation