REGular Blog: Big Banks Using the Credit Union Playbook - More Branches and a SEG Strategy?

A couple of banking news articles caught my eye this week because they highlighted a couple of big banks using some familiar strategies for those of us in the credit union world.

Chase to Build More Branches

On Tuesday, JPMorgan Chase announced plans to build 500 new branches over the next three years. Many branches will be in markets Chase has recently entered - Boston, Philadelphia, and Charlotte. This is a continuation of a multi-year strategy for Chase: Since 2018, they have opened more than 650 new branches and entered 25 new states. For scale, Chase currently has approximately 5,000 branches, so their new commitment represents a 10% increase - not insignificant. Additionally, only 17 banks today have more than 500 branches.

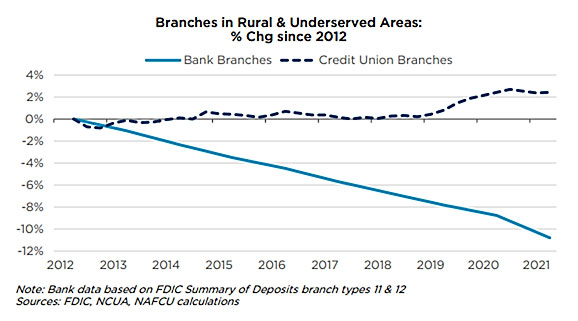

Opening new branches has been a hallmark of credit unions for over a decade. According to The Financial Brand and data from S&P Global, banks have had net branch closings every year since 2009, including 2,927 net closings in 2021. That same year, credit unions opened a net 46 new branches. In rural and underserved areas, credit unions' track record of opening new branches goes back years:

Even as banking continues to go digital, consumers still see the value of having a branch nearby if they need one. Chase is banking on that and plans to use their larger footprint for more than just cashing checks.

From the Wall Street Journal: "That said, the banks aren’t building for people to come to the teller line for simple tasks that could be done via an app. Instead, they want the branch to be a place where customers come for financial advice or to get a loan. They have turned some branches in lower-income neighborhoods into community centers, where they offer financial literacy classes and spaces for gathering."

Bank of America's SEG Strategy

On Thursday, Bank of America reported that they have brought in $10.5 billion in deposits and investments over the last four years by working with companies to offer financial services to their employees. The bank's employee benefits and investing program launched in 2020 and offers B of A services to more than 450 corporate and commercial clients. Bank of America reports that of the 4 million workers with access, 20% have used the services, bringing in $4 billion in deposits and $6.5 billion in client investment accounts.

A financial services provider teams up with an employer to offer services to employees as a benefit. Does this sound familiar? If your credit union has ever employed a SEG strategy, it should! Many credit unions were built on select employee groups, or SEG, relationships, and many still have this SEG-focused strategy today. Serving members who have a common bond through an employer goes back to the roots of the credit union movement. It's interesting to see Bank of America use this strategy, and to great effect - the assets they have brought in from this program since 2020 exceed the total assets of all but the 20 largest credit unions.

When I talk to policymakers, I sometimes hear the argument that "credit unions are basically banks now." I will say this: if "being a bank" means building branches to serve communities, providing financial education, and working with employers to bring valuable financial services to their employees as a benefit, then I guess credit unions have been "being like banks" for decades. When big banks are taking pages from the credit union playbook, we're doing something right. Though somehow I doubt they will be converting their charters and becoming not-for-profit cooperatives any time soon ...

- Share on Facebook: REGular Blog: Big Banks Using the Credit Union Playbook - More Branches and a SEG Strategy?

- Share on Twitter: REGular Blog: Big Banks Using the Credit Union Playbook - More Branches and a SEG Strategy?

- Share on LinkedIn: REGular Blog: Big Banks Using the Credit Union Playbook - More Branches and a SEG Strategy?

- Share on Pinterest: REGular Blog: Big Banks Using the Credit Union Playbook - More Branches and a SEG Strategy?

« Return to "REGular Blog" Go to main navigation